Our content is reader supported, which means when you buy from links you click on, we may earn a commission.

How to Prevent Credit Card Chargebacks and Keep Your Payment System Running Smoothly

Chargebacks happen every day to business owners all around the world. Here in the United States, chargebacks cost business owners over $40 billion each year in lost revenues.

In short, chargebacks are serious business – in that they are seriously bad for business.

Not all chargebacks are due to outright fraud, either. A surprising number of chargebacks arise from pure customer ignorance. Still, more fall under the category of “friendly fraud” (which, not surprisingly, is anything but friendly to the business on the receiving end).

In this article, learn step by step how to protect your growing business from chargebacks by learning best practices.

What Is a Chargeback?

The chargeback process is initiated when there’s a request to return paid funds to the customer or card holder.

Chargebacks serve as a form of consumer protection from fraud.

Contrary to popular belief, a chargeback is not the same as a refund.

A refund is an action initiated by the payee (merchant) to return paid funds to the payer (customer). A refund can represent the full amount paid or part of the amount paid.

A chargeback, in contrast, is an action initiated by the payer (customer) to rescind funds paid to the payee (merchant).

How Do Chargebacks Impact a Business?

When your business gets a chargeback notice, that means a payer’s credit card company has received a request from that payer for a return of paid funds.

The issuing bank then reviews the chargeback request and, if deemed valid, passes the payer’s request along to the merchant – you.

One fact many merchants do not know is that chargebacks do not necessarily have to mean a permanent loss of paid funds.

Once you get a chargeback notice, you can then move to dispute the chargeback.

How to Fight Chargebacks?

Disputing a chargeback is not as daunting as it may sound. However, it can represent just one more hat you have to wear as a small business owner.

As well, different financial institutions have different protocols for how a merchant can dispute a chargeback. But all institutions require that the merchant submit what is termed “compelling evidence” as part of the dispute resolution process.

Merchants must gather evidence that the funds are legally theirs.

This evidence may include anything from customer transaction histories to time/date stamps to social media chats to phone or chat transcripts to geolocation!

If all goes well, the financial institution will review the merchant submission and decide for the merchant. This decision will trigger a return of the lost funds back into the merchant account. It may also trigger a new chargeback request from the customer.

At some point, it can become more costly in both time and money to continue disputing a chargeback than to eat the loss and move on. This point is unique to each merchant and often to each transaction. For instance, it’s going to make more sense to pursue a chargeback on large orders of physical products than a digital product at a small price point since there was actual product loss in the first example.

By far, the easiest method for combatting chargebacks is a preventative approach. Taking a preventative approach begins with understanding why the majority of chargebacks happen.

Why Do Chargebacks Happen?

Credit card chargebacks happen for a variety of reasons. For this reason, the financial institution will always review a chargeback for validity before rescinding the funds and passing the chargeback notice along to the merchant.

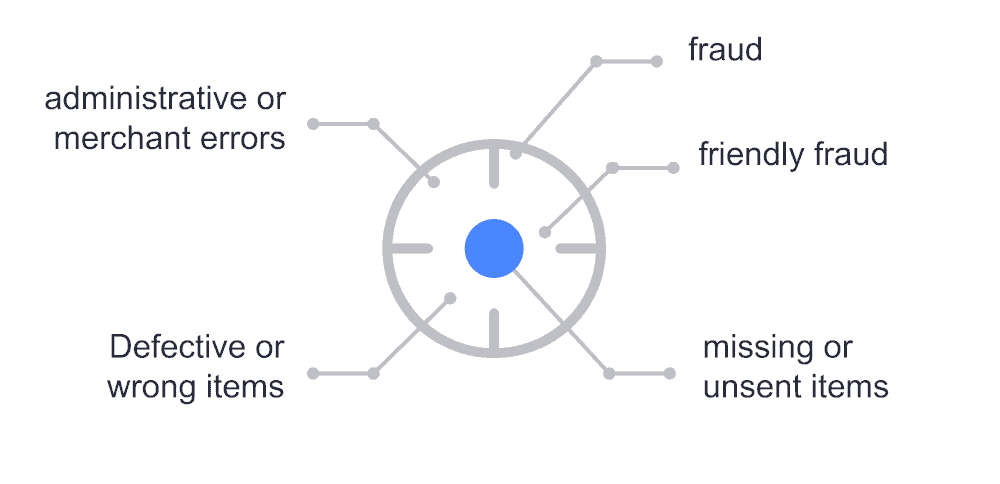

These are the main reasons chargebacks happen:

- Fraud.

- Friendly fraud.

- Missing or unsent items.

- Defective or wrong items.

- Administrative/merchant errors.

Let’s take a look at each one in turn.

Chargeback fraud.

The most common instances of fraudulent transactions occur during CNP (card not present) transactions. Forty-eight percent of chargeback-related fraud fits in the CNP category.

CNP transactions occur from remote purchases, or a customer is permitted to give the card number rather than present the actual card.

Outright identity theft and account takeover fraud is another significant source of legitimate fraud, accounting for an estimated seven percent of chargeback-related fraud.

Friendly fraud.

Friendly fraud is a term used to explain the choice to use chargebacks to get their money back – whether or not it is justified.

According to Forbes, friendly fraud is sufficiently damaging that some institutions are even teaching customers how to do it.

Friendly fraud is more prevalent now that nearly 10 percent of all transactions take place online where CNP (card not present) transactions prevail. For this reason, another term used to describe friendly fraud is “cyber-shoplifting.”

A customer using friendly fraud to gain the return of funds paid may use it instead of submitting a legitimate refund request. Friendly fraud is more likely to occur when the purchased item is not eligible for a refund.

Customers may also commit friendly fraud by saying:

- An item was not received when it was.

- An item was defective when it wasn’t.

- The purchase was not authorized when it was.

- They didn’t order the item when in fact they just forgot they ordered it.

- The wrong item was sent when they received the correct item.

- The item was not wanted when it was.

There are near-endless variations on these common themes. Some customers that initiate chargebacks under friendly fraud do so just because they over-spent their budget.

Missing or unsent items.

The rise of the “porch pirate” has made a negative impact on merchants in every area of business today.

Porch pirating is so prevalent some sources have now declared them to be “public enemy number one.”

Because of porch pirates, items customers say are missing may legitimately be so. In other cases, the item may be delayed or misrouted. In still other cases, the administrative error may reveal the item never got sent in the first place.

Defective or wrong items.

Even the most rigorous quality control checks won’t always weed out defective items. In the same way, human error may cause the shipping of the wrong item, especially where products look quite similar.

Administrative/merchant error.

Merchant error represents approximately four percent of chargebacks and includes duplicate charges along with incorrect amount charges. There’s not really much you can do to stop this other than find a reliable merchant account.

A good payment processor is typically well worth the fees. These will often offer an address verification service (AVS) which means a customer will need to enter the billing address on file for the credit card holder. It’s another way to check that this is an authorized transaction.

Tips to Reduce Chargebacks for Your Business

Every merchant must decide for themselves whether to pursue chargeback disputes.

Some merchants pursue only those chargebacks over a certain dollar amount while others do not pursue chargebacks at all.

Each of these tips can help on some level to reduce chargebacks at your business.

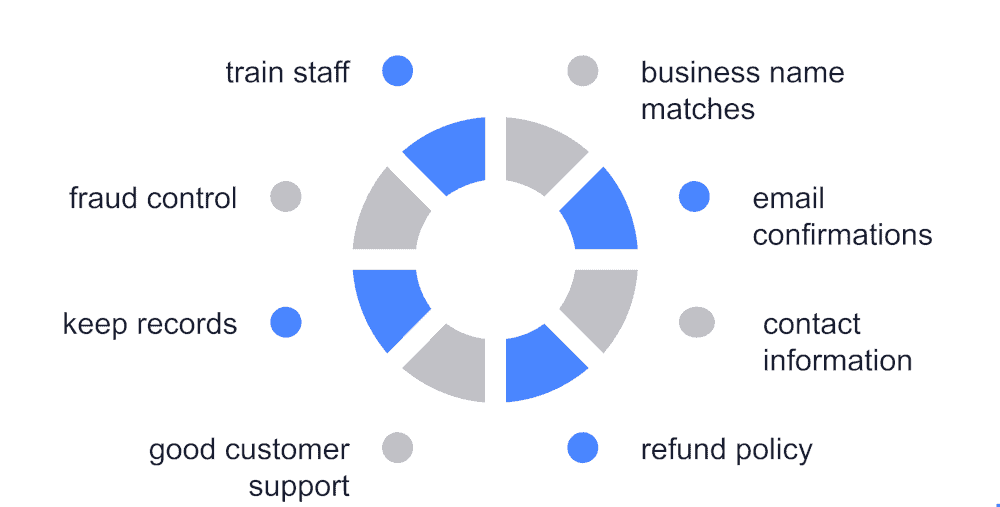

1. Be sure your business name matches everywhere online.

One of the most common reasons for chargebacks is an unrecognized charge on a credit card statement. Often this happens when a business has multiple DBAs or company names. Make sure customers know who the charge will come from.

2. Send customers email confirmations at each step of the way.

You will want to send out an initial email confirmation with the receipt. Then send another email confirmation when the order ships. Send another confirmation once delivery has occurred.

3. Provide your customer service contact information prominently.

You should include your phone number, business address, email, and chat (if available) in a prominent location on your website and on each receipt.

4. Provide your refund policy in plain language.

Have a clear plainly stated refund policy. This can make it harder for customers to submit a valid chargeback request with their institution.

5. Keep on top of social media questions, queries, and disputes.

Not only is social media a hotbed of eCommerce today, but in certain customer groups, social non-responsiveness can lead to lost sales and chargebacks.

6. Keep detailed records.

Detailed records are vital for any merchant that intends to dispute a chargeback. Without accurate documents that outline your side of the chargeback story, you are unlikely to reduce chargebacks and win those that come your way. Proof of the transaction, as well as proof of delivery, are two records you will need on hand to stand any chance of winning a chargeback dispute.

7. Implement fraud control settings across your platforms.

From using secure payment verification and processing software to instituting the highest fraud protection settings with your card processing vendors, the responsibility for limiting fraud ultimately rests with you.

8. Train billing and customer support staff well.

No business owner can be everywhere and do everything at once. Ultimately you will need to rely on staff to support the profitability and viability of your business. Staff training requires detailed training on how to spot potential fraud, conduct ongoing risk management reviews, successfully resolve complaints, and dispute chargebacks.

Is There a Way to Prevent Chargebacks From Ever Occurring?

Currently, there is no single approach to prevent chargebacks from ever occurring. Some industries are also more vulnerable to chargebacks than others.

With the inevitable increase of CNP (card not present) transactions, the emphasis must shift from prevention to interception of potential chargeback situations.

Use the tips here to limit your business’s exposure to future chargeback disputes.

Additional FAQs on Chargebacks

How can a seller respond to a credit card chargeback?

If you’re a seller who has received a credit card chargeback, there are a few things you can do in response.

For one, you can reach out to the customer to try to resolve the issue. If the customer is not happy with the product or service they received, you may be able to offer a refund or exchange. If the customer does not respond to your attempts to reach out, you can provide documentation to the credit card company showing you attempted to resolve the issue. This documentation could include emails, phone logs, or other records.

Another option is that if you have evidence that the chargeback is fraudulent, you can provide this evidence to the credit card company.

What payment methods do not allow chargebacks?

There are three main types of chargeback-proof payment methods:

- Payment methods that cannot be disputed include cash, checks, and money orders.

- Digital payment methods with no chargeback rights: these include Bitcoin and other cryptocurrencies, as well as some prepaid cards.

- Payment methods with limited chargeback rights: these include debit cards and certain credit cards.

If you’re looking to avoid chargebacks, your best bet is to use one of the first two payment methods listed above. Cash may not always be an option, but you can offer checks or money orders as an alternative. And if you’re looking for a 100% chargeback-proof solution, Bitcoin might be the way to go.

How do I get a high-risk merchant account?

If you’re looking to get a high-risk merchant account, there are a few things you’ll need to do.

First of all, you need to find a merchant services provider that offers high-risk accounts. This may require some research on your part, as not all providers offer this type of account.

Once you’ve found a provider, you need to fill out an application. Then provide some documentation about your business. The provider will then review your application and whether to approve you for an account. If you are approved, you’ll be able to start accepting credit and debit card payments from your customers.

What is considered a high-risk merchant account?

High-risk merchant accounts allow merchants to accept credit card payments. These are used by businesses considered to be high risk. High-risk businesses include online gambling sites, pharmaceutical companies, and adult entertainment businesses.

High-risk merchant accounts come with many benefits. These accounts include the ability to process online payments, accept international payments, and get high-approval rates. But, they also come with higher fees and stricter requirements than traditional merchant accounts. As a result, businesses need to consider whether a high-risk merchant account is right for them before opening one.