Our content is reader supported, which means when you buy from links you click on, we may earn a commission.

How Chuck McCabe Grew TheIncomeTaxSchool.com into a 7-Figure Digital Tax Training Company

- Who: Chuck McCabe

- Website: theincometaxschool.com

- Course Topic: Income Tax Training

- Interesting Stats: 60,000 customers and prospects

Who are you and what digital training company have you created?

My experience entails 45+ years as a tax industry leader. I’ve managed hundreds of tax preparation offices employing thousands of tax preparers in multiple states, both directly and through district managers. After being successful despite being a high school dropout, at age 31 I entered college for the first time. I earned an Executive MBA and ABD (all but doctoral dissertation) from Pace University, NY, NY.

I am the founder and CEO of The Income Tax School, Inc. (or ITS). It’s a private career school certified by the State Council of Higher Education for Virginia (SCHEV). ITS, founded in 1989, serves over 3,000 eLearning students annually-Worldwide. ITS offers over 40 different training programs, continuing education courses, and certificate programs with approximately 212,000 annual website visitors. Courses are developed by practicing tax professionals. ITS has an average Google rating of 5 stars, an A+ BBB rating, and was ranked #1 by TrendLists for online tax education.

What market does your digital training serve?

What market does your digital training serve?

ITS eLearning students include individuals seeking to become qualified for a rewarding professional career in tax preparation and/or to attain a professional credential through ITS Chartered Tax certificate programs. It also provides tax education and tax practice management tools to help independent tax pros build their practices.

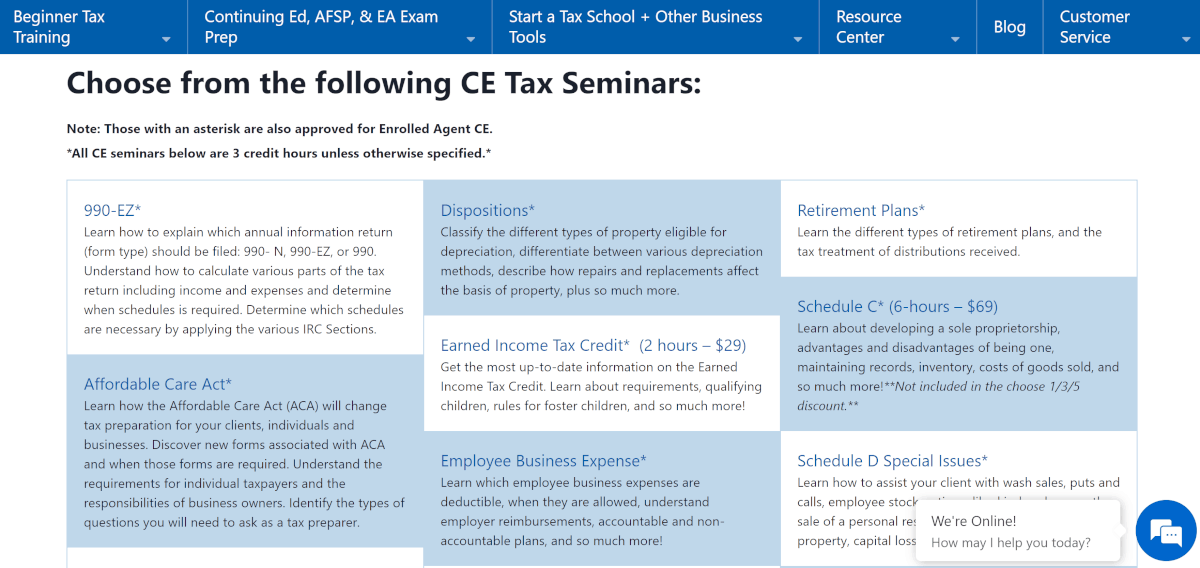

ITS is an IRS-Approved CE provider for tax professionals, a NASBA sponsor of CPE for CPAs, and a CTEC-Approved provider of Qualifying Education and CE for California tax preparers. ITS also provides everything needed for independent tax firms to deliver live and/or online tax courses to recruit & train new tax preparers and to provide employees with CE.

What’s the biggest benefit of taking your online courses?

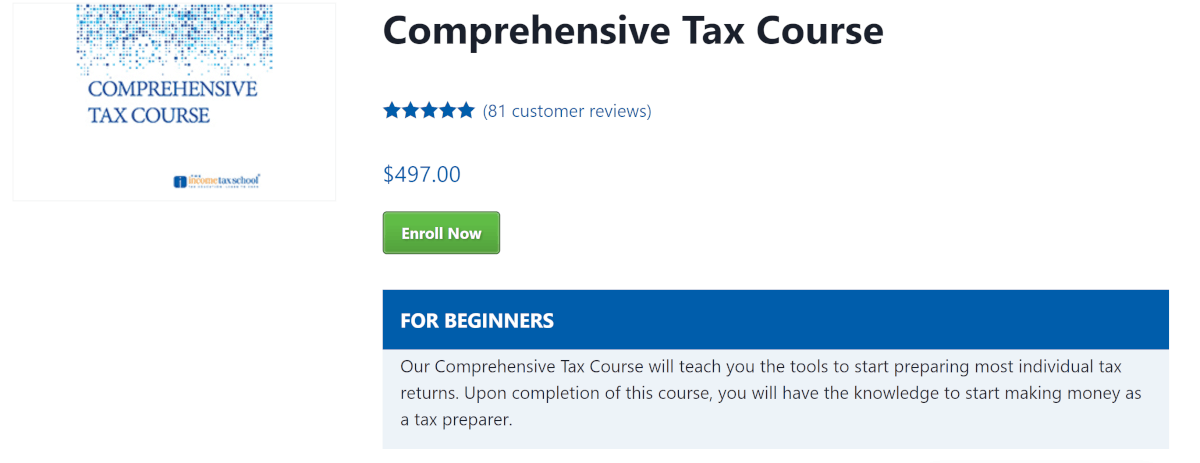

An individual with no prior tax or accounting experience or education can become qualified for employment or self-employment as a tax professional in just weeks for a cost of less than $500.

A tax business owner can use the ITS tax practice management tools to operate and build a professional tax business using proven best practices. All without buying into a very expensive tax franchise with perpetual royalties and restrictions on expansion and innovation.

How did you get into the market?

It’s a long story.

My first real job was as a freight brakeman and conductor for the Pennsylvania Railroad. At age 22, I was injured by being thrown off the top of a boxcar in a collision. After being out on disability for 3 months (and taking care of 3 younger siblings after our father was killed in a car accident and our mother was committed to a mental institution), I saw a TV ad for the H&R Block tax course and borrowed $60 from my fiancé to take the course.

Block had just reacquired the franchise for the NY Metro and my teacher (also age 22), who had been a Block office manager in Lincoln, Nebraska, was charged to expand from 3 offices in Hudson County, NJ to 9 offices. He asked me to help him fix-up offices. A week after tax season started he offered me a job as his assistant (for much less then the railroad would pay). I advanced to district manager and, at age 26, mid-Atlantic regional director and subsequently NYC and LI.

After 5 years as regional director, my boss was fired, and, as his presumed protégé, the Divisional Director told me I could either leave Block or become a District Manager (for $25,000 less pay). My wife and I met with a recruiter in Manhattan and he advised me to take the demotion and go back to school.

Education

In 2-1/2 years I earned a BS from the adult degree program at Adelphi University (Summa Cum Laude #1 in my class of 141 adults) and wrote two books as co-author with a writing professor to guide adults to and through college. My former boss acquired the major block franchise in Virginia and asked me to move to Richmond to be COO.

After 3 years he reneged on his agreement to share equity with me. We settled out of court and my wife and I found ourselves with 2 kids in middle-school and me not able to find a job at my level without relocating. After working for several months as COO for much lower pay, she said and I agreed that I should quit and start a tax business.

Why did you decide to create a digital training company?

After 2 years in the business, I started a tax school to recruit and train tax preparers and soon realized there was no other independent tax firm in the US with a tax school comparable to Block’s. I started to license it to other tax firms nationwide to generate off-season revenue. In 2003, I became aware of eLearning and decided to teach students directly online nationwide. The Income Tax School is now much bigger than the local tax business.

Did you have any moments of doubt before you launched your training company?

Being in business was a constant struggle and the tax business almost failed twice. My wife and I had many sleepless nights and financed the business with personal credit cards and credit lines, an equity line on our house, going without a salary, etc.

I struggled but I have always been optimistic, persevered, and never doubted my ability to succeed or thought that I was not good enough. -Chuck McCabe Click To TweetIf so what made you turn it around and do it anyway?

The only time I ever doubted myself was when I was a high school dropout and wondered if I would be good enough to succeed as a college student. Earning an A in my first college course and then graduating first in my class gave me much greater confidence in my abilities.

What are your online courses like?

Our course delivery is through a customized version of the Moodle open-source learning management system or LMS. Students may enroll and study at their own pace. We initially tried to develop our own LMS, but it was not stable. Then we used a pay-per-student LMS and later Moodle with a Moodle partner for support, also on a pay-per-student basis. However, since we are not like a college that has students for an entire academic year or a semester and many of our students are just taking short 1-3 credit hour CE seminars, we realized the pay-per-student model would be cost-prohibitive as we grew.

Instructor support is provided primarily by e-mail. There is reading and the entire student text is online. Students can also purchase a hard copy of the text for convenience and future reference. Students do not use tax preparation software because the software makes too many decisions and the student does not learn the tax laws.

Practice Materials

Practice tax returns are manually prepared off-line and the results are entered online. This practical application results in the student internalizing the knowledge. All quizzes and tax return problems are automatically graded. A certificate of completion is provided for each course. The courses do not include lecture-type videos but do include video PowerPoints with audio developed in Camtasia. Below are links to student reviews, our school’s credentials, and a demo of our courses.

- Comprehensive Tax Course Description (includes Learning Objectives and Table of Contents

- Comprehensive Tax Course Student reviews

- ITS credentials

- Demo

We have an independent contractor who helps us with LMS development, primarily using open source plug-ins.

How long does it take you or your team to create a new course?

Creating a new course takes numerous hours and updating a course (required every year due to tax law changes) probably takes 60-70% as long. Our Comprehensive Course is 16 lessons and our advance I&II and small business I&II are each 10 lessons. Each lesson probably takes at least 100 hours of curriculum development to write and 60-70 hours to update. The lessons go through about 4 phases of editing and formatting and then we upload to the LMS.

We currently only have two employees who are in-house curriculum writers. We have transitioned to some 20 independent contractors because it is not feasible to find enough qualified, experienced tax professionals who also have excellent writing skills.

Our Tax School Director hires and manages all curriculum developers. They are provided with examples and detailed instructions, processes, and specifications for writing style, outlining, developing quizzes and exams, formatting, etc. I do not personally write or check any of our curricula. I prepared thousands of tax returns in my early career and wrote our first course, but I cannot be a CEO, and also a technician and a tax expert.

Tell us a little about the process of launching your first course and getting your first enrollment(s).

I opened our first office in September 1987. Then I added 2 more to make 3 for our first tax season (1988) and recruited enough tax preparers to start. My plan was to expand aggressively and knew from my Block experience I would have to create my own tax school to recruit and train employees to support our growth.

In Virginia, a career school charging tuition must be approved by the Department of Education (now SCHEV as noted earlier). I read the requirements, but could not apply because 2 years of business history was required. So, I convinced the local community college to hire me as an adjunct instructor to teach a three-college-credit course in income tax preparation, which yielded enough graduates to staff my 7 offices for the 1989 tax season.

In September of 1990, I opened our Virginia licensed proprietary career school. We expanded aggressively during the early years and were recognized among the 25 fastest growing companies in Metro Richmond for four consecutive years.

We then had financial challenges and, due to competition and legislation changes we started to lose market share. However, both Jackson Hewitt and Liberty Tax outsourced their tax school to us for their first two years of their existence while focusing on developing their franchise operations. At that time “Peoples Income Tax School” was a division of Peoples Income Tax, Inc. It is now a separate company, The Income Tax School, Inc.

Do you have a lead magnet?

We do not offer free trials, but we provide our course demo and have had four professionally produced “explainer videos” created for our four main products. The link to the video for our Comprehensive Course is on our website on the page at the link below (scroll down halfway). We have multiple free white papers requiring registration and providing your email address.

We also provide installment payment plans for each one of our five core courses and our three Chartered Tax certificate programs. Of course, we have a refund policy and numerous 4-5-Star student Reviews.

What’s the traffic strategy that works best for you?

Again, our main source of leads is organic search. We have over 220,000 unique visitors annually and some two-thirds are new. We also have a sophisticated blog and professional social media marketing provided by an independent contractor. Our daughter is our marketing director and she does a great job with digital marketing. In addition, we exhibit at the IRS Nationwide Tax forums in 5-6 cities each summer (probably not this year due to Coronavirus).

We have a database of over 60,000 customers and prospects. We’ve just introduced a rewards program to increase the number of repeat customers and next we plan to launch a membership program. We are always taking advantage of opportunities to obtain positive PR.

I have also written the book, Guide to Start and Grow Your Successful Tax Business (published in-house and sold to students for $100 ($70 for digital version). We will be publishing a Second Edition this year. My daughter does the editing, formatting, and illustrations, as well as contributing to the marketing chapters. Roger Russell, Senior Editor of Accounting Today wrote the book forward. Back cover testimonials include a retired IRS Commissioner and a top Intuit executive (we had created an online course as a pilot for Intuit). In addition, we have multiple distribution partnerships with colleges on a revenue-sharing basis.

What online course platform are you using?

As I mentioned previously, we use Moodle, an open-source platform that we have customized using various open-source plug-ins and several plug-ins that we pay for on a licensing basis.

We have an independent contractor who helps us with LMS development, primarily using open source plug-ins. A few years ago, Blackboard bought the two largest Moodle Partners, including Moodlerooms; I think because the lower-cost Moodle was encroaching on their market share. Most Moodle users are provided with support from a Moodle partner.

Do you like it?

Yes, I like Moodle because it is like having our own in-house LMS and we can continue to make enhancements.

Are there any features you wish it had?

Yes, our Tax School Director has a wish list. We can add just about anything we like by finding a plug-in for it, or, if necessary by doing custom programming.

What made you decide to use your chosen platform over others?

The main reason was the excessive cost of using a pay-per-return LMS. We also like having more control and the ability to add any features we would like as we are able to afford them.

What other tools do you use to run your digital training business?

We utilize state-of-the-art technology whenever possible to enhance customer and employee experience, efficiency, productivity, and reduce costs.

We use MS Teams for virtual meetings with independent contractors and our LMS administration/development team. Then we also use a Live Chat feature on our website and the Zoho CRM. Last year we upgraded our shopping cart to WooCommerce and we use Webgility to electronically transfer shopping care orders to our Quickbooks Enterprise accounting software.

What books or training programs have you found useful on your journey to a successful business owner that others might find valuable too?

My favorite classic book for entrepreneurs is The E-Myth Revisited by Michael Gerber. In college, I read every book written by Peter Drucker. Other books are Entrepreneurial Terror by Wilson Harrell, Small Giants by Bo Burlingham, Traction by Wichman, The Rockefeller Habits, and many others I can’t recall right now. Some of these authors have been speakers at retreats of the Virginia Council of CEOs (of which I am the Founding Chairman).

Do you have any big mistakes you’ve made along the way that you’d be willing to share?

Expanding too aggressively in my core business, Peoples Tax. Trying to implement too many new ideas before we were ready. There are always many more opportunities than one can act upon. It is important to choose only the few that promise the greatest return.

Please share some idea of revenue for your digital training company.

I’d rather not share our exact revenue. It is 7 figures with rapid growth (30%+ last year). The variable cost of additional eLearning revenue is 20% or less; as a result, our cash flow is excellent and we haven’t had to use our bank LOC for more than a year.

Please tell us a little about what the money you’ve earned from running your digital training company has done for you.

We haven’t been able to take many vacations due to business challenges. But our positive cash flow has enabled us to increase our compensation significantly, pay off our mortgage, eliminate all personal debt, buy a new vehicle for cash and accumulate wealth for retirement, including the value of our business.

In addition to revenue are there any numbers you would like to share?

We are a small business, but our website gets 600 – 1,000+ visitors per day, with 2/3 being new. Our traffic increased significantly since last September when we launched a redesign of our Home page and four key product landing pages. Displaying all four products on our home page caused problems. Instead, we devoted the vast majority of our homepage to the product we sell the most of.

I also founded the Linkedin group: Tax Business Owners of America that has grown to 8,777 members

What has creating your digital training business done for you personally?

I love being in the education business and operating my own school and being an entrepreneur. This may be due to my personal experience of being a High School dropout and earning advanced degrees. I also like to teach and have taught courses on small business management at several colleges as an adjunct.

What advice do you have for people just starting out?

My journey was not the traditional route, but not much different than many others. I feel blessed to have been born in the United States. My main advice is pretty common.

Find a career doing what you love, follow your dream, and never ever give up. Being an entrepreneur provides freedom. -Chuck McCabe Click To TweetRecruit employees who have a good work ethic, not only education credentials (maybe not any). Put them in positions where they can enjoy working. Help them to succeed, even if that means losing them to another opportunity. Finally, develop systematic methods of operating your business and focus on making yourself expendable.

Learn more about Chuck McCabe and theincometaxschool.com:

- Websites: theincometaxschool.com

- YouTube